At the beginning of January I did a little 2012 recap and shared some goals for 2013. I wouldn’t go as far as to say I created resolutions, but I did touch upon a few big changes we made in 2012 that we want to continue to work on in 2013. One of these big changes is to follow the Dave Ramsey Total Money Makeover.

I’ve been meaning to expand on all of the points I made in that post (including going Gluten-Free), so for today I’m going to start with our Total Money Makeover experience: where we were, where we are now, and where we are headed in the future.

(If you are reading this post anywhere other than HouseofHepworths.com, then it is stolen content. Pardon this interruption but a blog has been stealing my posts, so I have to put this memo imbedded into my post.)

Before we began the Dave Ramsey program we were giving the impression that we were doing well, but in reality we were drowning in over $35,000 in credit card debt and had a total of about $55,000 in car debt (two cars with loans of approximately $15,000 and $40,000). We paid off our student loan debts several years earlier. When we sat down and added up all our credit cards and car debts, I’m pretty sure I might have cried. I didn’t realize it was that bad.

Something had to give. We just couldn’t go on like this anymore. We were putting everything towards the credit cards each month, but because we continued to use them and because we felt like we made enough money to warrant not following any type of budget at all, no matter how much we sent to the cards, the balances continued to grow.

In walks Sarah’s post about her journey to paying off $125,000 in debt by following the Dave Ramsey financial plan. Her post was so inspiring that I immediately bought the book and began reading. Pretty soon Ben was on board and the journey began.

We stopped using our credit cards cold-turkey and started using a real cash budget. It was painful. It was hard. But it was WORTH IT.

Ben plays the guitar and a few years ago for Christmas I got him a fun hole punch that punches guitar picks out of credit cards (pretty sure I paid for it with the credit card). Each time we paid off a card, we punched that card into several guitar picks. Now we have a jar full that make me smile every time I see them. It’s a good visual reminder of where we were and where we are headed.

We quickly knocked out our smallest credit card bill (a few hundred dollars) and it felt so good and really jump started our journey.

This isn’t a final “DEBT FREE SCREAM”, but it’s a significant update of our journey. As of two weeks ago we paid off our very last credit card!!! We paid off all $35,000 in credit card debt! It feels so so so good to say that.

Dave constantly talks about having a “Jaguar Moment”. He bought a Jaguar when he was younger before he could afford it. When he went bankrupt he still tried to keep his precious car. He hit an all time low when he was begging friends to help him make his car payment while he was practically homeless. He said that until he accepted and came to terms with the fact that he needed to sell his car, he would never be able to fully commit to digging his way out of debt and becoming financially free.

Everyone has to have a “Jaguar Moment”. Everyone has something in their life that they don’t want to let go of. Until you can part with that item, you will never be fully committed to changing your life. Our “Jaguar” was also a car. Actually, a minivan. We purchased a very nice, very expensive, very upgraded Honda Odyssey Touring Elite. It had leather seats, sat 8 people, and was fully loaded including a GPS system, a DVD player, and a wide-screen that would show two movies at once. We took out a 6-year loan to afford it, and even then our payment was more than $600 a month. After following the Dave Ramsey plan for months and months, we knew we needed to do what we had been putting off; we needed to sell the van. It was the one item that we were unhealthily attached to. It was painful and took us several months to admit, but the van needed to go.

Our real internal change finally happened when we dropped the Odyssey off, sold it back to the dealer, and drove away in Ben’s little Civic. I thought I’d be devastated. I thought I’d sob on the way home. Instead, my reaction shocked me – I was FREE. I was free from that huge $40,000 burden. And it felt amazing.

Currently we still only have one car. We have $9,000 left on it. We are in a unique situation that Ben works from home, so for now, we have one car. And we will continue to have only one car until this one is paid off and we have enough cash to purchase another one. I complain daily about not having my own car, but I know if we wait until we can pay cash for another car, not only will we own it outright and not be in debt, more importantly (in my opinion) we will be so proud of ourselves that we were able to save up and buy it in cash.

I will let you guys know, but in fair warning, we are on a Dave Ramsey tangent and will do almost anything to pay off every last stitch of debt possible. Dave says that you should sell so much stuff (our garage sale!) and make such drastic changes that the kids start to worry that you will sell them!

Speaking of the kids, they have watched us buckle down and pay off the debt. They have heard us tell them “no” over and over when they ask to go out to eat, or get a treat, or go on vacation. We have been very open about the Dave Ramsey debt plan with them every step of the way. We paid off our last credit card with them, and then we all went out for fro-yo afterward to celebrate together. It has truly been a family affair.

Last Christmas we took it one step further and bought them each Financial Peace Junior. They have taken to this program 100% and have become quite knowledgeable about finances. Paying off our debt hasn’t just affected Ben and I, it has truly changed our entire family.

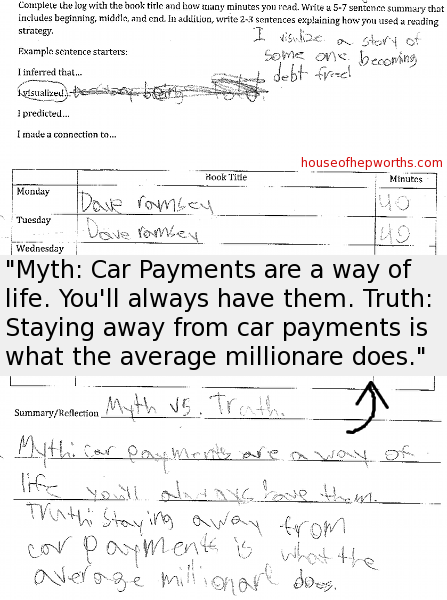

Our son got so into the program that he actually read the whole book and did a little report on it at school! (He’s in 5th grade). We thought it was so cute/funny that we scanned it in:

I’ll admit, this was a proud-mommy-moment for me.

We bought a 10-pack of Total Money Makeover books before Christmas and gave every person in our family a copy. Several of our family members are now also doing the program and tackling their debt head on.

This is a marathon, not a sprint. We will continue to “live like no one else so later we can live like no one else”. I’ll update periodically about where we are at on our journey. Next up is to pay off Ben’s car, buy me a car, and possibly downsize to save hundreds of dollars a month on our monthly mortgage payment. After that? Start saving even more for retirement and college funds, save up for a much-needed family vacation, and pay down the house.

A random side-note: My blog brings in a litte money on the side. Not a lot, nothing to sing home about, but enough to give me some money to decorate my house with (which I then turn around and blog about. Full circle moment here). We decided right away, a long time ago, to not use the blog money as part of our debt payoff program. So when you see me buying something and then blogging about it, don’t judge! Don’t worry, we aren’t falling off the Dave Ramsey financial plan wagon. We have purposely set up our budget so that any money I make from ads on my blog I get to keep to help fund future projects that I blog about.

As Dave would say, “We are doing better than we deserve.”

*This post contains affiliate links to amazon.com.

Everytime I hear you talk about this I want to jump on board. Problem is, I don’t know where to start.

Guess I should get the book first huh?!

Start listening to his free daily podcast. Also the book is great!!

Just drop by Dave’s website and he has a mini start up guide on how to get out of debt.

your story is so inspiring, congrats on your journey! also, it’s really annoying someone is stealing your content.

I just found out about the content theft. I’m trying to deal with it. The dumb thing is that they are stealing posts that have my info plastered all over them, so it’s totally obvious! Weird.

So happy for you! I can just feel your excitement! Little admission here… we have never even sat down and figured out a budget once in the 15 years we’ve been together. I have no idea what we spend on groceries or eating out or anything really. Luckily, we’re both very frugal and don’t have any debt (besides our mortgage), but it scares me to think about how much waste we could have just because we’ve never seriously looked at the numbers. I might be buying this book too. Congrats to you for your journey!

Budgeting is no fun and we avoided it for years. Its worth sitting down and doing though just to know. Mint.com is an easy way to track if you are interested. It’s free too.

I just had an “aha” moment. We are just starting Financial Peace University. WOW it is not fun but the hope for freedom is so motivating. We are like Natalie, we don’t have a lot of debt, we are very frugal but live without a budget and at the end of the month we still don’t have any money in the bank. Frankly I’m tired of living like not one else and not getting the reward of living like no one else. Confession : I have read story after story of how much debt people are in and I think but at least we aren’t that bad. The “aha” moment was when I was reading your post and apologetically started thinking that same way. Reality is just like when you are trying to lose 20lbs or 100lbs if you aren’t 100% committed it doesn’t work. You know how you say to yourself I’ve tried to eat really good, that really means yes you have tried to make healthy decisions but your are sabotaging yourself with those few cookies because after all you have been sooo good. Ok so maybe that was a lot of confession there. Thank you sharing your journey, we are taking the course by ourselves watching the DVD’s at home so we don’t have anyone to really talk to about it. An inspiring car story is a friend of mine went through the course three years ago, they paid off everything except mortgage and has saved enough to buy, with cash a nearly new Volvo crossover.

My hubby also works from home and we’ve been a one car family for 4 years. It was a rough adjustment at first, but now it’s pretty normal. There are certain occasions where we need two cars, but for those, we just rent a car for a few days. Lots cheaper than having the 2nd one sit in the garage all the time!

This is a really good point. It’s been fairly easy so far, I just don’t like driving his little stick shift civic. I miss having an SUV of van! Now that soccer season started its been harder to juggle but we are figuring out ways to make it all work.

GOOD for you! We gave up our credit cards 14 years ago and have been on a cash system ever since. It was so hard at first; almost like an addiction! Now I am so thankful we chose to do it, and I know you will be too. The light at the end of your debt tunnel is growing closer every day, and I hope you tell us when you get there.

You are an inspiration! Congrats on avoiding the credit card pitfall all these years. We are so close but still have years of work we can do. I just want to retire nicely and send my kids to college without that burden on them. Living with a budget is a lot of effort but so worth it. I’ve never really been good at managing money but I’m proud at how far I’ve come!

Very inspiring and a fantastic read! I (we) need to get out of debt. I am happy that you and your family are almost debt free and that you make enough from blogging to continue to do projects. Thank you for sharing your story. Inspiring.

Thank you for sharing your story. Inspiring.

You can do it! It is so worth it.

Way to go! My husband had quite a bit of student loan debt, and we haven’t cut as many corners as we could (and maybe should) but we’ve stayed in our little apartment that feels way too small, stuck to basic phones with cheap monthly plans, and have paid so much towards our debt that our next payments aren’t due for years. It’s a wonderful feeling! I really appreciated what you said about your house, because we always think that once we do buy a home, we want to buy as big as we can afford, so that we’ll never “have” to move because we run out of space – but there are definitely more important things in life!

You are doing it right! You will be so happy in the long run that you waited it out and paid down that debt.

Molly: I hope your excess payments have been put toward principal reduction, which in turn reduces the total amount of interest you pay. Just paying extra payments may delay your having to make payments for years, but you are not out of debt and the interest is still being paid. I am not the best person to explain this, but I do recommend you investigate this.

You shocked me with the house selling! Thats huge!

I think it takes a lot of courage to do what you guys have been doing, and I admire that… Way to go!! Yay!!

Can’t wait to hear more updates! (and about your gluten free change!)

Thanks girl. I’m sure I’ve shocked a lot of people, especially all my local friends and neighbors who are just now finding out we might move. :/ I appreciate your kind words. I hope that me keeping it real helps others in their own journeys.

We sold our “bigger” house in 2011. The only reason we qualified for it was because we did an adjustable mortgage and made the interest only payment for two years. It was a fixer upper, and after 7.5 years of dumping almost $100k into it, we decided to sell and unload our large monthly payment (and a house that STILL needed another $100-$150k in work). We now live in a slightly smaller house in a not quite as nice neighborhood, but our mortgage is a fixed payment that costs us less than it would to rent. We went from three stories to one, and I can clean this house in less than half the time! There are days it feels a little cramped, but our kids will be going to college in just a few years and then it will be perfect for two people. My husband and I love to travel and “do” things…a bigger, nicer house wasn’t worth being strapped every month. I really don’t think you’ll regret the decision if that’s what you decide is best for your family.

Congrats Allison. This sounds so awesome. And I applaud you for teaching your kids about finances. I always wish my parents would have shared that with me and I entered adulthood unprepared. Luckily I had a husband who taught me instead.

And yes, there’s something to be said for doing more with less. Just because we can afford to live in a bigger place doesn’t mean we should. What if we are perfectly happy with the place we have? I love going on vacations and I’m perfectly happy that maybe I don’t live in a bigger place in exchange.

My husband & I are on step 2 right now. Curious as to how long it took you to pay off the $35K? Will be sharing your post with my hubby Congrats! Can’t wait to be where you’re at

Congrats! Can’t wait to be where you’re at

Reading posts like this make surfing such a plsreuae

Wahoo! How awesome is your family! THat is so cool to cut your debt that much. I admire you cutting back on the extras to pay off your debt! Can’t wait to see if you sell the house or not!

I’m doing a happy dance for you! That is so crazy exciting, and it feels so good to have you share about it. That it is not easy, but such a great feeling, and worth doing. I have always been a saver, and my husband as well. We’re just natural tightwads. One time, my brother-in-law was telling us what a great rate he got on a mortgage re-finance and was asking us if we were thinking of one. We told him no, as we were probably going to pay off our house within a year. He paused, and then told us, “That’s un-American.” It still makes us laugh. (He’s a great guy, and frugal, too.) We have been blessed (and also definitely been conservative in our finances) and have never had a student loan, car loan, and we paid off our last home in just four years! We moved away from Texas a year and a half ago, and hope to have this house paid off in another few years, if I can stay disciplined and not go all crazy on the house. (I really want to change some major things!) If you haven’t seen this SNL skit, you HAVE to watch it! http://www.hulu.com/watch/1389

YAY! We took Dave Ramsey’s Financial Peace University and worked to pay off all of our credit card debt. I am paying extra on our car payments and can’t wait to see our vehicles paid off! It was a huge challenge and a big shift from our usual spending. BUT our boys see us using cash only and the huge weight of credit card debt is gone. Keep up the GREAT work!

I am so with you! The hubby and I have been discussing selling our house. Our old home was a fixer upper of 2800 sq. feet, but had too much grass to cut (5 acres) and just yard to maintain. We built our 4600sq ft. dream home almost 9 years ago and I am so over it. We so love it, but beginning to have a love/hate relationship with it. It takes me FOREVER to clean and now with blogging….I want to create and decorate not clean. Eventhough we have little grass, we are slaves to landscape! We are ready to downsize so we are not slaves to it. We can afford it, but travel and extra savings have been put on the backburner. We have decided to get it ready to sell, downsize now to save for college and travel. In 4-1/2 years both kids will be in college! I’d rather downsize now and save money and enjoy precious time with the family! We won’t even mention the credit cards….ugh!!! We did just recently stop using them though. I have had the book on our book shelf for several years and have just ignored. You have given me motivation to pull it out!!!

So, so, so happy for you! My husband and I started working hard to pay off debt last fall and paid off a ton so I would be able to stay home with our daughter! We still have a ways to go, but knock a little out each month! I still have not read Dave Ramsey’s book, but I’m thinking its a must! Thanks for sharing your journey!

Jenna @ Rain on a Tin Roof

My wife and I paid off over $300,000 in a year and a half and have been debt free for over a year now – it’s freaking amazing! $100,000 of our debt was in credit cards and car loans and $200k was in a house that was too big and way too far away from where we worked – so we had 2 jaguar moments – one where I sold my Harley and two when we sold the home (and we’ve had 2 garage sales). We rented for 2 years to finish off our debt and saved up enough for a huge down payment and enough cash to cash flow our remodel of the new house. Now we’re expecting our first child and my wife can stay at home all she wants and we’ll be perfectly fine. It’s amazing how much cash you wind up with when it’s not going out the door with a thousand little cuts.

Sort of a follow up to this story – if you are a DR follower, you know he touts the importance of an “emergency fund” – first a baby one and then a fully funded one that should be 3-6 months of your expenses. Well – we’ve had our 3-6 month fund for a while now and just this week had to use it for the first time. And I can’t relay just how much of a relief it was to be able to spend $5k without it impacting anything with our lives and being able to make the decision to do it and not regret it.

You see – this week, our 12 year old dog decided to eat something he shouldn’t have – something so long and indigestible that it wasn’t coming out. We took him to a series of vets and finally found a surgeon that diagnosed the problem – and recommended immediate surgery – at 6pm on a weeknight. My wife and I discussed it briefly and decided to go forward with the surgery. After praying about it, we decided that this wasn’t his time to go – and if it was something that could be fixed rather then just treated we were going to do it. And yes, our savings took a hit – but it’s paid for, we still have a cushion and our dog who has stood by us so loyally for so many years now will be able to meet our son that is going to be born in the next few months. That my friends is what an emergency fund is for.

I love this story! You should call into DR and tell him this. He loves hearing stories like this. Thank you so much for sharing.

Good for you. I’ve read your blog for a couple years now and had no idea you guys struggled with debt. None. It’s nice of you to share, as I think many of us see your “nice life” and assume that it’s easy. Personally, I am hoping you don’t move … all the personalization you’ve put into that beautiful home! But I understand it. I tell my husband we should sell the house and move into an RV. He’s not on board, at all. Thank you for sharing your story.

Wow! You are so inspiring to me! I’m sharing your post with my husband! How long, if I may ask, did it take to pay off your credit card debt? You being able to do it, gives me hope that we can too! Thank you for sharing!

It is good to be weird!! We are also on the Dave Ramsey plan. You and your family are doing so great! What a great feeling it will be when the last of the debt is done with and the call can be made to Dave Ramsey screaming “we are debt free!!!!”

That is awesome! We’re doing the Financial Peace University program right now through a local church. Your car loan myth above we just went over in our Wednesday night class. We haven’t had the gumption to sell a car yet but we have paid off one credit card and placed a huge payment on another. Just paying off that one card was a good feeling.

Wow. I need to read that today. My husband has now been unemployed for almost 6 months, he was a bread winner. We also have a large beautiful home. Even can still afford our house, but I wonder if need to afford it, or if we had a smaller home and increase our monthly savings. I think I’ll start with finding that book. Thanks!

GREAT FOR YOU!! We are also a Dave Ramsey-following family. We have paid off a student loan, a car, and all of our credit cards following Dave’s plan, We currently only have our home as our debt- but have started making bigger payments to pay if off sooner than our 30 your mortgage timeframe. Keep at it!!

Congrats! When we got married over 8 years ago, my husband’s aunt and uncle gave us a signed copy of the Total Money Makeover. We’ve totally benefitted from starting out using Dave’s budget—we’ve never had credit card debt, and we’re paying off our student loans early (some are already gone, others still hanging around, since we haven’t always been “gazelle intense”).

But that aunt and uncle? Just a couple of months after our wedding, they won Dave’s Total Money Makeover Challenge. They paid off a tremendous amount of debt, won a cruise and $50,000 from Dave, and now own a much more comfortable home outright. On one salary, with four kids. They’ve been a total inspiration to us, and if it wasn’t for the TMM, I’m sure we’d be drowning in debt, just like most other people our age.

Way to go Alison! We are currently coordinating our 4th Financial Peace University class and we’ll make our final debt payment in just a few days. Thanks for sharing your story, it’s such an inspiration to all of us on the weird wagon!

Our family graduated from the Financial Peace 2 years ago. We paid off our 30 year note in 14 years while living off one salary. Good luck to you…It’s truely life changing!!!!

Vraiment vous me donnez l’envie de voyager ! Les belles photos et les commmentaires sont au RDV ; et ça fait plaisir de lire que vous ne vous êtes jamais sentis dans l&qc.uo;insésuritérBon , Je vais prendre ma pelle et mon balais pour déneiger mon accès à la rue .Nous n’avons pas les mêmes conditions de vies …je ne m’en plains pas !Bises

Way to go Allison! We are a cash only house too. At first I HATED IT, sometimes I still do After I calculated how much money interest added to my student load, I freaked out a little and got on board. When we wanted to buy a house, my husband and I decided to buy a smaller house than the bank said we could afford because we don’t need a huge house for such a small family. The loan person mention 4 TIMES we qualified for a much larger loan and could buy a bigger house when we signed the papers. Yeesh.

After I calculated how much money interest added to my student load, I freaked out a little and got on board. When we wanted to buy a house, my husband and I decided to buy a smaller house than the bank said we could afford because we don’t need a huge house for such a small family. The loan person mention 4 TIMES we qualified for a much larger loan and could buy a bigger house when we signed the papers. Yeesh.

You should be so proud of yourselves! My husband and I have been debt free for 20 years of our 22 year marriage – except for one car loan that we got because it was 0% interest so we thought it was a better choice financially. We, however do things exactly the opposite of Dave. We put every single thing on one credit card that we get cash back on. Every month we pay the balance in full – NO exceptions. By doing this, we are able to look item by item what exactly we spend our money on. We also don’t use a budget. I feel like making a budget would “give us permission” to spend more than necessary. For example, if we budget $100/month on eating out, we would spend the $100/month because it was in our budget. Without a budget, we might only spend $50/month on eating out. We also have set amounts that are automatically taken right out of my husband’s paycheck so we don’t even miss it. The money goes into a savings account, a retirement account, and college funds for our kids. We don’t miss it because we never even see it. Keep up the great work!

We do the same thing. Everything goes on ONE credit card and gets paid off at the end of the month. I’ve managed to earn about $1500.00 cash in cash back rewards every year that we’ve done it. I feel like the credit card companies are now paying US back for all those years we had CC debt! You do have to be disciplined, though.

Wow, you guys are doing great!!!! Our family of 5 downsized from 3400 sq feet to 1625 sq ft and it was an adjustment. Honestly though it has been good for us! We recently went from 2 cars to 1. I loved my Pathfinder but the hated the payment. Unfortunately my husband doesn’t work from home and we’ve had to make adjustments but with good communication and planning it is working out. Not to mention I’m getting a lot of exercise walking our youngest to school and walking when I volunteer at the school. I’ve learned that I might have been spending more on stuff we didn’t need only because I was bored and went to Target. My 16 yr old and I currently have a competition going to see who can save up enough money to buy a car for cash 1st! Making lemonade out of those lemons I guess ;). It isn’t always easy and there are a lot of times I gripe about it all but its working at the moment and you are right VERY freeing.

Congrats! You guys should be really proud of yourselves! I think the best thing you can do is teach your children about money and budgeting. My parents bought a house they could easily afford and never had new cars, so they never had a car payment. I was lucky they taught me the same values. I set a budget for myself in college (of course the $ value has changed over the years), but I was able to save up enough to buy a new car with cash. When I was looking at houses I was approved for about twice as much as I ended up spending. I didn’t want my whole paycheck to go towards my mortgage. Anyway, keep it up! You’re almost there!

Congratulations on taking the first steps to becoming debt free. I can tell you honestly I’ve never had a credit card and I’ve always paid cash. I’ve never understood people purchasing items if the money doesn’t exists in the bank. If I don’t have the cash to pay for it- I don’t deserve it. The cars I buy have always been pre-owned and all those little accessories you mentioned that you had in your van can be added to a vehicle for a 10th of the cost. By watching your cash, you will find you have more money over the years- seriously. My fiance and I bought our brand new 4,500 foot home with cash. There was no need to qualify because the money was sitting right in our accounts. I bet you can imagine all the gold star treatment we got from all the realtors. You are probably thinking there was no way we could seriously pay cash for our home- yes we did. Here’s how: never eat out- instead invite people over for a social by having a potluck, I dye my own hair and do my own nails, I coupon and only buy groceries I need, all my cleaning supplies are homemade and this saves hundreds of dollars a year, my clothes I buy on clearance. This biggest way I saved money on decorating my house was by going to garage sales. You won’t believe the amount of people out there who are selling brand name furniture because they mismanaged their money and have to go into foreclosure. I should stop rambling and leave you with this- if your credit card balance is higher than your savings account (notice I didn’t say checking account) YOU DON’T DESERVE TO BUY IT!

Thank you for sharing! I have read Sarah’s post too about it. I actually have the Dave Ramsey book but haven’t started reading it yet. You are yet another person to motivate my husband and I to “get it done!” I have a friend (family of 3) who love to vacation in Florida (we live in cold WI) so they decided to downsize and try to sell their home too! No luck yet. Whatever you decide, good luck!

Christine

I (thankfully) married someone much more financially conservative than me! We coupon and plan and save and then we enjoy the fruits of our labor guilt-free! Oh, and we sleep soundly every night in a home with not much owed on it!

Welcome (almost) to the club!

Christina

Incredible!!! Very inspiring. We’re currently on a plan to have $21k in debt paid off within the next 12 months. The only other thing of debt would be our mortgage, and I can’t wait to start dumping money on it!!

Wow…this is awesome! I’d really like to get my husband on board with this plan! I think it’s right up our alley…we’ve done a lot of this in the last year in preparation for buying our home. I think it would be good to get him on this before we end up in a lot of debt again!

THANK you for this post!

Congrats! This is such a long journey and a lifetime change, not a just in the momment, get rid of the debt and forget about it journey! My parents were extremely good with money. They worked hard and for themselves. They paid for their cars, always used cash, etc. We lived in a 1400sf modest house. I had a fantastic (not spoiled) childhood and we took a vacation every year. In fact 4 kids graduated from college without school loans.

In college I started my love affair with Visa. I thought my mother was going to call the CEO, she was so angry. How could they just give these to college kids!? She knew exactly why and that is what made her so angry! And now years later (literally 14 years), I still sit here with a CC bill because I can’t seem to put it away. It’s the only secret I keep from her! But it’s time to put it away. Hope to join you on your journey!

AWESOME on all accounts! We love Dave Ramsey in our house! We took the class in 2006 and have been budgeting and saving ever since to go on a ten year anniversary trip next year to Europe…all because of one little class! Our older two kids have the previous Dave Ramsey Kid’s Banks and I am so bummed that they recently changed them to a new style. We loved them and I have three more little ones that still need them. (I guess I will have to DIY something in the future.) Congratulations on ALL that you have accomplished…it really is a BIG achievement and your story will inspire so many people!

We took the class in 2006 and have been budgeting and saving ever since to go on a ten year anniversary trip next year to Europe…all because of one little class! Our older two kids have the previous Dave Ramsey Kid’s Banks and I am so bummed that they recently changed them to a new style. We loved them and I have three more little ones that still need them. (I guess I will have to DIY something in the future.) Congratulations on ALL that you have accomplished…it really is a BIG achievement and your story will inspire so many people!

~Sarah

Yes,our family is also weird! We will be paying off the remainder of our mortgage in 2 months time and we bought our home a mere 3 years ago – yay! After our home is paid off,we will be completely debt free – another yay! Our friends,family and neighbors think that we are so strange as we pay cash for everything and have never had a car payment and live within our means – weird,huh? So many years we were ridiculed for having a pay as you go phone – no bells and whistles – just a phone that takes basic pics,has text service but we just smiled and embraced our weirdness.:-) There are a million and one things you can save money on,if you just look around your house and use your common sense. If more people realized what a sense of freedom you have when you become debt free,I think we would have a lot more happy people in the world.

We will be paying off the remainder of our mortgage in 2 months time and we bought our home a mere 3 years ago – yay! After our home is paid off,we will be completely debt free – another yay! Our friends,family and neighbors think that we are so strange as we pay cash for everything and have never had a car payment and live within our means – weird,huh? So many years we were ridiculed for having a pay as you go phone – no bells and whistles – just a phone that takes basic pics,has text service but we just smiled and embraced our weirdness.:-) There are a million and one things you can save money on,if you just look around your house and use your common sense. If more people realized what a sense of freedom you have when you become debt free,I think we would have a lot more happy people in the world.

This is so inspiring…and you are so cool to share such a persona story with us! I’m totally going to pick up his book and see what areas in our life we can trim the fat!!! xo

Way to go! My parents were debt free and very open about their budget and financial decisions. My husband and I are continuing the “tradition” and living a debt free lifestyle. We just booked a vacation to Disney World with cash! Your kids will thank you one day!

congratulations.. Been there done that so I can verify for any doubters that this is truly possible. YOU DID IT!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Congrats! You are doing better than you deserve. You are so NOT normal. And we’re right there with you! We’re paying off $450K, including the house. Only $66k left. It’s an 8 yr plan. So looking forward to our 100% debt free visit to Dave Ramsey! Keep up the good work.

Allison,

Strange question – does your daughter have a ceiling fan in her bedroom?

Maureen

Allison that is wonderful! Thank you for writing about something that people are afraid to talk about. I have already told you that you are the reason I ran out and bought Dave’s book and CD. I have already given my sister the book to read and I listen to the CD EVERY.SINGLE.DAY on my way to work to reinforce Dave’s words. Thanks again Allison and Good Luck!

WOW, what an awesome post! I LOVE Dave Ramsey and you really do not need that big house. Big house = big roof with big $$$ to replace, big utility bills, lotsa time cleaning, etc etc. I am not one of those 287 sq foot people but I have lived larger and smaller and large is not better. We decided we would rather spend money on experiences rather than stuff.

I have wondered why you would write, “I couldn’t afford this or that” and think what the heck is she talking about? Sure looks like she can afford it. Why doesn’t she say she chooses not to spend the money and wants to do it less expensively or something more honest. I was JUDGING all the while thinking I never do that too.

Thanks for writing and we can pray may the stalker get her own life.

I am so glad you got rid of the Van with the 6 year loan!!! I bet that did feel good when you drove away, just getting rid of that amt of money that was owed! The money that freed up, that could be applied somewhere else! Now if the President (& Congress) would be willing to quit spending money that the U.S. does not have! I grew up very poor & worked on a farm, buying my own clothes since I was 10-13 yrs. old. We got married in ’89 and fortunately, never had student loans (either paid for it ourselves or had grants.) We had under $900.00 in our account when we married. Don’t know if I would recommend that small of a savings now! We have lived off of one income. Over the yrs, we have bought 6 vehicles & paid cash for 5 of them (1 was a very small loan, and went ahead and paid it) We have a mortgage,(going to refinance to 15 yrs), but no credit card debt. We do charge groceries/gas on a rewards Visa, HOWEVER, pay off the balance monthly. I know how to coupon, shop 50%-75% off sales for our clothes. We don’t run out and buy the latest electronics—still don’t have HD or big screen. Sometimes I think I am all most apologetic when I say we paid cash for our vehicles–guess I don’t want someone to think I am bragging. I shouldn’t feel that way! I am very thankful for what we have and can’t believe it, compared to how I grew up.

For your readers, I want to suggest a great couponing website

http://www.southernsavers.com/free-coupon-video-class/ for someone wanting to learn to coupon (not hoard items).

the//thebargainwatcher.com/sales.asp is a site for finding out about consignment sales (not stores) for used baby/children’s items (type in the state). You can sell (children’s) items there, and keep 70% of your selling price. I will email you a thought for the house. Thanks for sharing and you have encouraged some others to do the same!

Congratulations for how fat you’ve come in such a short period of time! My hubby talked me into becoming debt free over two years ago and since December, we have been debt free except for the house! I too, gave up a car I loved for an older model with more miles (we both commute to work so one car isn’t possible) and although I complained, it’s so nice not having a car payment. We are sacking away cash for our emergency fund and hope to start being able to splurge soon!

As for the house… I still get house envy when I drive through neighborhoods with huge homes but I’ve learned to embrace our smaller home and the fact that we will have our home paid for soon!

Thank you for sharing and letting me know that my family is not alone! We were debt free once and after selling a house with $20,000.00 in mold repair costs and a change in employment for less pay, we are becoming debt free again. We have 14 months to go! I love the pins and the post!!!

Thanks for sharing your story! We too are struggling with our debt and we’ve tried to stick to Dave’s Plan. It’s so hard! Every time we get money saved towards our Emergency Fund, something comes up. But I’ve been so thankful that we’ve been able to have what money we do for emergency’s as in the past those things always went on a CC. I look at all the things we’ve been able to pay cash for the last six months and am so thankful that, none of it ended up on a CC. I struggle with wanting to get rid of my SUV and get something cheaper {we have to be a two family car, and I drive a ton for my job} but my car has so many miles on it that I would still owe thousands of dollars on it after trading it in. My husband’s truck is almost paid for and he keeps asking if he can get a new truck and I keep telling him NO!

I hope that you’ll continue to share your journey as it gives others like me hope that Dave’s plan can really work. :o)

I bought the book and read it. Got a feel for it. Then let things slide. I got serious again in December. I have my full year’s budget done (salary and subject to any changes necessary) but it feels great. We just reached our $1,000 savings this week. Next month we get to pay off some debt!!! Looking forward to it. This post just makes me even more determined.

In the fall, we were looking for a new SUV. 4 of my co-workers got new vehicles and I felt like we should be getting one too (our current SUV is 2003). But with 6K left and Dave Ramsey in my mind- we are waiting until we absolutely need a new vehicle(although I doubt we could pay cash). I have even given up coffee to save $1.75 a day

So proud of you guys! Also-thank you for sharing and helping me feel better about our 1400 sq ft home. Even people in the big homes are going through the same thing as us!

Hi, I just wanted to stop by for a second and let you know that I applaud your decision. This is so highly important and support you 100%.

Thank you so much! I appreciate all the support from everyone.

LOVE Dave Ramsey. Good for you guys! Keep up the good work.

That is so exciting! We are also on dave’s plan, but slightly modified since my husband is in a commission-only sales job. We love it, but it’s hard to know how much to plan on each month. Such an inspiring story though and I’m so happy for you guys!

Great story! Congratulations! We are trying to live “weird” too, thanks for sharing your story

I can feel your excitement! It’s a great feeling being able to tackle your debt head on. We have lived paycheck to paycheck for many years now, and when my husband finally started making more money, the first thing we had to do was get a 2nd car, because his commute was too far. I was left stranded with no car and 2 small kids for 14 hours a day. Not to mention the car guzzled a car payment in gas each week. It was horrible, but eventually we caved and I found the cheapest and most fuel efficient car for my husband. (Mazda 3 Skyactiv if anyone wants to know, $18k). It wasn’t fun, because it took a $345 chomp off his new paycheck then and there. But since then, we have paid down our credit cards. We still use them, but I pay them off every paycheck. And now we’re just digging ourselves out of the little hole we had been in since my husband had been underpaid for 3 years. Getting silly stuff like new shoes, work clothes for my husband, clothes for our kids, who are growing like weeds. Getting various things for the home, like a new mattress, since the one we’re currently sleeping on was spent 5 years ago.

And then, we’re off to tackle the gaz guzzler’s car loan, hubby’s small student loan, and then the 2nd car. I just hope we can stay in our home, and he doesn’t get another job, far, far away from home again. Currently he has a 1+ hour commute, and we’d be looking at 1 1/2+ hours…

I started reading you blog because the black door story caught my eye but this get out of debt information is just what I needed today I find in my house hold its feast or famine.I truly feel im at the bottom of a mountain of debt and boy that mountain looks big from here.

Complete;y inspiring! Thank you.

Allison, I’ve been thinking about doing Dave Ramsey myself, and I recently mentioned trading in my vehicle for something with a lower payment. What do you mean you sold your minivan back to the dealer? Did you trade it in on a lower priced vehicle? I actually prefer my old vehicle that my husband is now driving. So, I’d rather get my old vehicle back and let him get a pickup truck with a lower payment. Another plus is that my old vehicle is paid off. When I say “old,” it’s a 2005 and still runs great. Why do we think we all need the latest and greatest??

You’ve been an inspiration yet again, and I think I’m going to stalk e-bay to find a cheap deal on The Total Money Makeover book.

I have another question for you? Do you have a subscription to use Dave’s budget software? If not, what type of budget are you using?

THAT’S SO AWESOME. The hubs and I took Financial Peace at a local church and it so impressed us that we brought it to our own church – and facilitated twice.

Your post hit me at a good time (now that I’m, um, catching up on blogs). I had the nerve to feel sorry for myself for not getting the coveted Bobbi Brown makeup and ordering fabric instead to make my own much-needed curtains with thermal lining, to keep the draft out.

Allison, we’ve had old cars for a while. Luckily, right now we live near a good and honest mechanic. Within the last four months we’ve paid cash for two cars from him. It’s great to have good transportation with no ongoing payments. You all will get there too, since you’re already going such a great job of managing your finances after finding Dave Ramsay.

Congratulations!!! Hard work pays off! My husband has always been a saver and never wanted to use credit cards unless it was an absolute emergency. We bought an old fixer-upper farmhouse with 40 acres, scrimped and saved and paid off our mortgage in about 12 years time. I took our kids along for the last payment….and we made a party out of it! There are so many money-saving things to do….and we’ve been doing them our whole married life. The secret is having a goal of “Freedom” from debt. Taking control. I make simple, inexpensive meals, have a large garden, cut my husbands and boys hair, hang out clothes to dry in the warm months, shop for clothes at Goodwill, the list could go on and on. We are always looking for new ways to save money. Let me tell you….it is ABSOLUTELY FANTASTIC to be able to say…WE ARE DEBT FREE!!!!!! Nothing like it!!!!! It’s hard work…..but WORTH IT!!!!!!

Love, love, LOVE Dave Ramsey! You go girl! This is the kind of stuff that transforms lives, and it is so clear that the lessons you are teaching (and the wealth that you are building) will totally transform the lives of your kids. Keep on keepin’ on! Lots of us are right there with you!

We did this two years ago. Although we did not have debt. we were having money issues because we weren’t really saving and we have two different money personalities in our home. SOOOOOOO much better now. We both have become more aware of our own pitfalls with money and we have a huge savings now that I never would have thought possible. And our kiddos do the junior program too. They LOVE it!

Horray for you all! Keep gazelle intense!

Hey girl! I’m so proud of you!! Isn’t it the best feeling ever?? It is an amazing journey but gets wayyy better after, you will love it. Thanks again for the link!

Thanks again for the link!

I can’t find the weirdness here. Being debt-free is totally normal.

We too are working hard to get debt free. We too Dave Ramsey’s FPU class 2 years ago. We’re getting really close. We can see the light at the end of the tunnel. Such a good feeling.

We tried to make changes to save the environment and our pocketbook at the same time. My wife quit her job, and took on a new one in the same building as me. Then, we sold our country acreage and bought an older home in town, a 15 minute bike-ride away from the office. Living so close meant we could ditch a car, and save on insurance and maintenance as well.

Although it meant a slightly bigger mortgage, our lower payments through refinancing, and massive savings on fuel (we were each spending upwards of $250 a week commuting – thats $500 a week in gas!) made moving ridiculously close to work, and my wife taking on a new position a great financial decision. A few more changes and we should very secure very soon.

We paid off all our debt but mortgage and had money in savings to cover mortgage and utilities for 4 months when my DH lost his job. You better believe that I praised God for giving us the wisdom to prepare a safety net.

Hi! I stumbled across your blog via a “Dave Ramsey” search. We follow his program, as well. Love it! I find his podcasts especially motivating. I listen daily via iHeart. In your post, you wrote about how much you enjoy decorating. With that in mind, I hope you will take time to check out my blog – http://www.frugaldesigngirl.com. It is committed to the idea that you don’t have to spend a lot of money to live well. Good luck on becoming debt free. It feels so good to be weird!

Good luck on becoming debt free. It feels so good to be weird!

FDG

Congratulations at this huge accomplishment! I love it that you are getting your kids involved. I laughed so hard about your van story. My husband and I are blessed to teach right next to each other, so we carpool to work and we sold his very nice truck. However, we do have a backup vehicle: an ugly brown 1988 Ford Truck with a plywood bed. It is a sight to see! I complain every morning about carpooling because he is never ready, but he reminds me of the $7 a day we save!

Thanks for sharing your story. I’m motivated now to start working on my debt snowball

Oh my gosh, I just want to scream at the top of my lungs how excited I am for you! But since we are in cyber space, I will just yell digitally – YOU ARE AWESOME! I am a huge Dave Ramsey nerd and I don’t want to ramble on too long but the total money makeover changed our lives! We are at the very tail end of our final student loan debts and we are scrambling to sell everything we possibly can so we can make it on our very frugal family vacation in 3 weeks. It was our own personal goal that if we could pay off the loans by the time vacation was here we could go. It’s annoying our families that we can’t commit but we are so close we can taste it! It’s going to finally feel so good when we can scream ‘We’re debt free!’. If you’re interested I shared the start of our journey on my blog, you can read it here http://bit.ly/11eqBuS. I just can’t even tell you how excited I am for you! I will be thinking about your family and rooting for you guys to get there too

Wonderful blog! I found it while browsing on Yahoo News. Do you have any tips on how to get listed

in Yahoo News? I’ve been trying for a while but I never seem to get

there! Cheers

Hooray! My husband and I got our Dave Ramsey book as a wedding gift 5 years ago, and I swear it was the best gift we got that day. I can’t remember how much debt we had at the time, but with student loans, car payments, and credit card debt I think it was close to 30,000. Now we’re finally ready to start paying the mortgage off. We have friends that worry and worry about money and it’s so nice to be able to tell them “We did this, and it works.” Keep us all posted on your progress!

Thank you so much for your post on this! We too are doing this program – – we don’t have the book, but listen to his radio program and have paid off all but 2 credit cards (now both have small balances and should be paid off in the next few months), one car payment and our home. It is so exciting to hear of other families doing the same and gaining this wonderful freedom!! Way to go!!! =)

I loved this! My husband and I have offloaded 150k in debt through this program and are now debt free!!! And we did the one car thing for awhile also. It wasn’t fun but it’s rewarding in the end. Like the program says, if this were fun and easy everyone would do it. Anyway, we just finished coordinating our first FPU class and I feel so blessed to see that this program works in others lives as well. Keep up the good work lady! Yes, most people think we’re nuts but I don’t care; we’re happy, our home is free from money arguments, and we’re setting our kids up to win in the future. That’s more important than their opinions

Great post. I’m dealing with some oof these issues as well..

Love this and love Dave’s system. We are in baby step 4,5 and 6. We switched to the cash system about 2 years ago and it made a huge difference. I really can’t say enough good things about it. I love it so much that I even started to make my own pretty debt-free envelopes and started selling them on Etsy. If you have a chance, check out my store.

https://www.etsy.com/shop/CraftySundays?ref=hdr_shop_menu